Compress lines in POS

Client always ask question when using LS retail POS about compressing the same lines if same item is scanned more than one time. For example customer buys 5 bottles of soya sauce of American Garden, it should appear as 1 line with 5 quantities in POS instead of 5 lines for 5 quantities.

Let us see how this can be achieved.

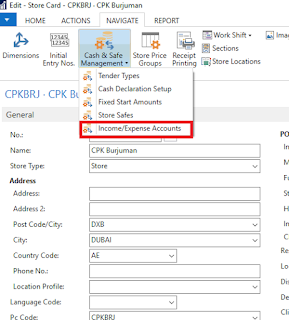

1. Go to the functionality profile which is attached to the Store/Terminal.

2. Navigate to the functionality card and tick mark the Compressed when scanned option as shown below

3. Check below the POS line for once compress when scanned is checked and when it is unchecked.

I hope you guys like the post, keep liking and keep sharing.